Links to various Aetna Better Health and non-Aetna Better Health sites are provided for your convenience. Aetna Better Health is not responsible or liable for non-Aetna Better Health content accuracy or privacy practices of linked sites or for products or services described on these sites.

“So much of it was a mystery”: Why helping people understand Medicaid is more important than ever

By Eric Spitznagel

By Eric Spitznagel

Member names and other details have been omitted or fictionalized to protect the members’ identities.

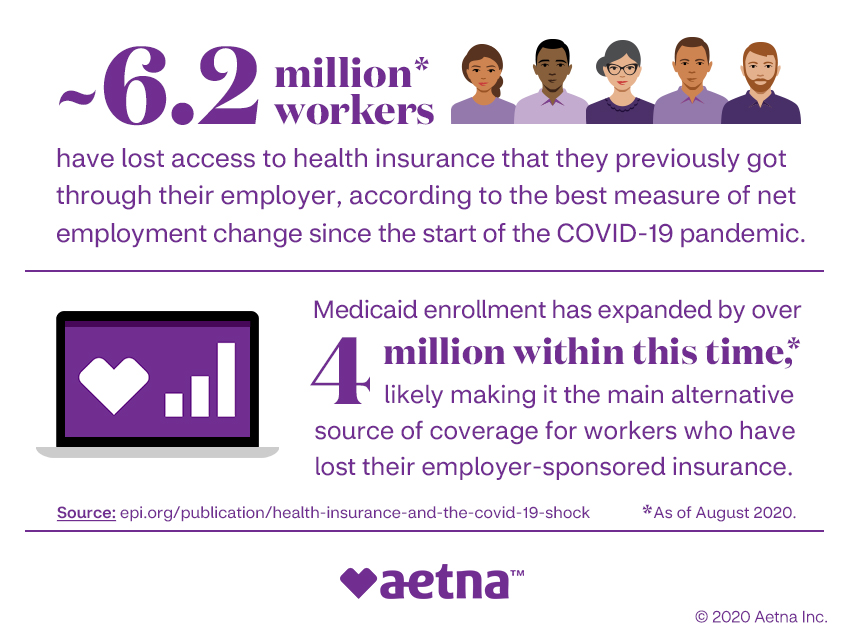

~ 6.2 million* workers

have lost access to health insurance that they previously got through their employer, according to the best measure of net employment change since the start of the COVID-19 pandemic.

Medicaid enrollment has expanded by over 4 million within this time, * likely making it the main alternative source of coverage for workers who have lost their employer-sponsored insurance.

Source: epi.org/publication/health-insurance-and-the-covid-19-shock

*As of August 2020.

©2020 Aetna Inc.

Amid historic levels of unemployment, millions of Americans aren’t losing just their financial security but their health insurance as well. According to the Economic Policy Institute, as of August 2020, an estimated 6.2 million Americans had lost health insurance that they previously got from their employer. This includes not only the people who lost their jobs but the family members who depended on their insurance plans.

This happened to Paula A., who was laid off in April from a job that she’d held for almost a decade. The reason, she was told, was cutbacks because of coronavirus-related financial losses.

“It was like having the rug pulled out from under me,” says the mother of two in her 40s. As the family’s sole breadwinner, she was concerned about her family’s financial future — she had a mortgage to pay and college tuitions on the horizon. But her immediate worry was health insurance. Paula had the option of buying into her longtime insurance plan, “but the costs were too much,” she says. “It just wasn’t something we could afford.”

She considered applying for Medicaid, the federal- and state-funded health insurance program, but the eligibility requirements seemed scary and unclear to her. “Did I even qualify for Medicaid?” she asks. “What are the financial requirements? I had no idea. So much of it was a mystery to me.”

Paula may have felt alone, but she’s actually part of a growing trend. At least 2.3 million Americans enrolled in Medicaid during the first several months of the COVID-19 pandemic, according to researchers from the University of Minnesota. But for many, taking that leap to Medicaid isn’t an easy one, and they need guidance.

Aetna is ready and willing to help. We’re committed to making the process of finding health coverage during difficult times less like a maze and more like an open door. By simply visiting the Aetna Better Health® site for her state, Paula was able to find the answers she needed (and some she didn’t know she needed) by clicking on the “Become a Member” section. We have a history of providing care above and beyond what’s typically expected of an MCO (managed care organization), and we’re committed to continuing that service for our members during the COVID-19 pandemic.

Helping families navigate the eligibility requirements for Medicaid isn’t just about giving families the peace of mind of knowing they’re covered. It’s also about encouraging them to make smarter medical choices. Without insurance, people are avoiding doctors even when it's urgent. Emergency room visits fell by 42% in April, according to the Centers for Disease Control and Prevention. And there's been a big falloff in routine medical care, with an estimated 36,000 breast cancer screenings and 19,000 colorectal cancer screenings delayed since the pandemic began, according to medical research company IQVIA.

Paula says that after losing her insurance, she canceled her annual checkup. And she was neglecting more than just her own health. One of her children has a peanut allergy, and the medicine was close to expiring. “We could take our chances and hope for the best,” Paula says. “But I didn’t want to be that parent. What if the worst happened? And it was all because I was too proud? I couldn’t live with myself.”

Becoming an Aetna Better Health® member didn’t solve all of Paula’s problems, but it did give her one less thing to worry about.

The same was true for Christopher B., a student in his late 20s that lives in Northern California. He’s had chronic health conditions for years, but due to a change in his circumstances, he decided it was time to make the transition to Medi-Cal, California's Medicaid program, with Aetna Better Health®.

Applying for it was easy — “A social worker at the hospital did it all for me,” Christopher says. “I just had to sign a couple of forms.” But his biggest fear was losing his regular team of doctors.

“I was forced to switch care teams,” he says. “That really upset me. The doctors who first started taking care of me since my diagnosis didn’t take Medi-Cal, so I had to switch to another hospital.”

But he soon learned that making the decision to go with an Aetna Better Health® plan was a blessing in disguise, even though it meant giving up his regular care team.

“It was honestly the best thing that’s ever happened to me,” Christopher insists. “My new team is incredible. I feel like I’m getting the best care of my life. And it’s all because of Medicaid. At the time, it felt like a concession. I had to sign up for it because I couldn't afford anything else and I didn’t have a choice. But honestly, this is exactly where I need to be.”

Medicaid is there even when the worst happens. Just days before the shelter-in-place order was issued in California in March 2020, Christopher was diagnosed with the coronavirus. His care team got him tested for it on the same day he came into the office and set him up with the necessary care.

“I’ve never felt so taken care of in my life,” he says of his doctors. And then he adds with a laugh, “I’ve also never received a bill. That’s something to feel good about right there.”

Both Paula and Christopher feel grateful that they were encouraged to become Aetna Better Health® members. It was, they agree, one of the best decisions they made for their overall health. Paula says she’s been especially impressed with some of the benefits that she and her family have received from Aetna, like free mental health counseling and prescription deliveries.

“We’ve all been dealing with a lot of stress because of the coronavirus,” she says. “But this takes some of that stress away.”

She’s had her annual checkup through telemedicine and gotten her child’s peanut allergy medicine. It was all fully covered. “It’s hard to describe the feeling,” Paula says. “There are still struggles, but now I know our health isn’t one of them.”

The times ahead are uncertain, but Aetna Better Health® is committed to being a port in the storm for people who have fallen on difficult times. When life can seem the most scary and uncertain, Aetna is there to take at least one worry off their minds.

About the author

Eric Spitznagel is a frequent contributor to Vanity Fair, Billboard, Men's Health, Playboy, The New York Post, and the New York Times Magazine, among others. He's published eight books, including his latest "Old Records Never Die: One Man's Quest for His Vinyl and His Past." He lives in Chicago with his wife and an 8-year-old amateur scientist.